LETHAL LOAN

In the past couple of days or weeks, Government of Sierra Leone and some other people who are oblivious of the effects of foreign loan to low income countries like Sierra Leone celebrated the 38-Month Extended Credit Facility which is about USD 253 Million from the IMF.

If foreign aid is being described as "Dead Aid" by Dambisa Moyo (a world renowned economist), therefore I can't hesitate as a local journalist to refer to foreign loan from Western Financial Institutions like the IMF and World Bank as LETHAL to Africa.

In her book titled: Dead Aid, she argues that, foreign aid is plunging African countries into poverty, rather than alleviating the continent from a menace which many believed is "man made scourge."

The argument of Dambisa Moyo is clear, she presented compelling statistics illustrating that, poverty in Africa rose from 11% to 66% between 1970 and 1998 which were periods when the continent records the highest flows of foreign aid.

Referencing Dead Aid in this context is just a premise of the title of this article- LETHAL LOAN.

Why do I have to coin it this way?

In the past couple of days or weeks, Government of Sierra Leone and some other people who are oblivious of the effects of foreign loan to low income countries like Sierra Leone celebrated the 38-Month Extended Credit Facility which is about USD 253 Million from the IMF.

Almost all government official social media handles captioned this foreign loan as "Breaking News" because Sierra Leone "secures" USD 253 Million from a Western Institution which loan facility always go with tough economic and financial conditions that have dire consequences to the ordinary man and woman in the street.

Foreign debts either from the World Bank, IMF or China have significant effects on low-income countries like SierraLeone, and most times negative effects outweigh the benefits.

One of the side effects of foreign aid is High Interest Rates or Payments. Many low-income countries Sierra Leone as a case study spend a huge chunk of their budgets on repaying debt, leaving less for essential public services like health, education, energy and more.

This economic inadequacy later results to "Debt Trap" wherein countries may end up borrowing more to pay off existing loans, leading to a cycle of dependency, rising debts, high levels of poverty and poor service delivery.

A key factor to Sierra Leone and other low-income countries' Currency Depreciation and High Inflation Rate is highly influenced by external loans. Countries are facing exchange rate issues because they are borrowing in foreign currencies like the USD. In the event the currency weakens as our situation in Sierra Leone, debt repayment becomes more expensive because of high exchange rate.

Even at household or individual level, debtors are almost always not moving freely. Some will even go into hiding depending on the amount of money being borrowed and the duration.

If this is happening at the "microeconomic level" what about the bigger picture - wherein a country is borrowing from international financial institutions like the IMF and World Bank. This can lessen or reduce a country's sovereignty - as external loans almost always come with conditions from lenders as the International Monetary Fund or the World Bank.

This to a larger extent limit a country’s ability to independently manage its economy. These conditions often require austerity measures (can't verify whether it was an IMF or World Bank conditionality during the EBK Era), cuts in social spending (eg. removal of subsidies from fuel etc), or structural reforms like closure of certain institutions that can seriously affect poor citizens.

President Julius Maada Bio has travelled more than any other head of state in Sierra Leone since the beginning of the millennium. With this high number of overseas travels, very little is shown in terms of foreign direct investment in the country.

Do you know why? Sierra Leone is a highly indebted country with an estimated foreign debt of $ 2,331,196,990 (two billion, three hundred and thirty one million, one hundred and ninty siz thousand nine hundred and ninty, World Bank, 2022).

Note: I used this report because I was unable to have recent data on Sierra Leone's external loans.

According to IMF (2022), total public debt rose to 93% of the Gross Domestic Product from 79% of 2021.

The report further states that, this increase was due to: sharp depreciation of the Leones (67.3 percent depreciation at the end of 2022), high fiscal deficit in 2022 - which led to substantial additional domestic borrowing.

High levels of debt as the case of Sierra Leone can deter foreign investors who fear instability or economic collapse. Consequently, this economic lapse hampers the country’s ability to attract the kind of investment needed for development.

We all aware that, "Africa is addicted to foreign aid," however, if not in trillions but the billions of USD that have been injected in to Africa by the West in the last decades have very little to point at taking into account sustainable developments.

Foreign debt is not just LETHAL, it's ineffective and counter-productive. It creates dependencies, props up bad governments, discourages transparency, undermines local enterprise, reduces incentives to save and stunts growth.

What does Africa needs for Sustainable Economic Growth and Development?

The continent urgently requires alternative models of development; and among include: debt relief, healthy trade, and foreign investments. When these economic models are in full swing, they have the potential to be more effective in promoting growth and reducing poverty which has gripped Africa for so long.

_____________________________________________________

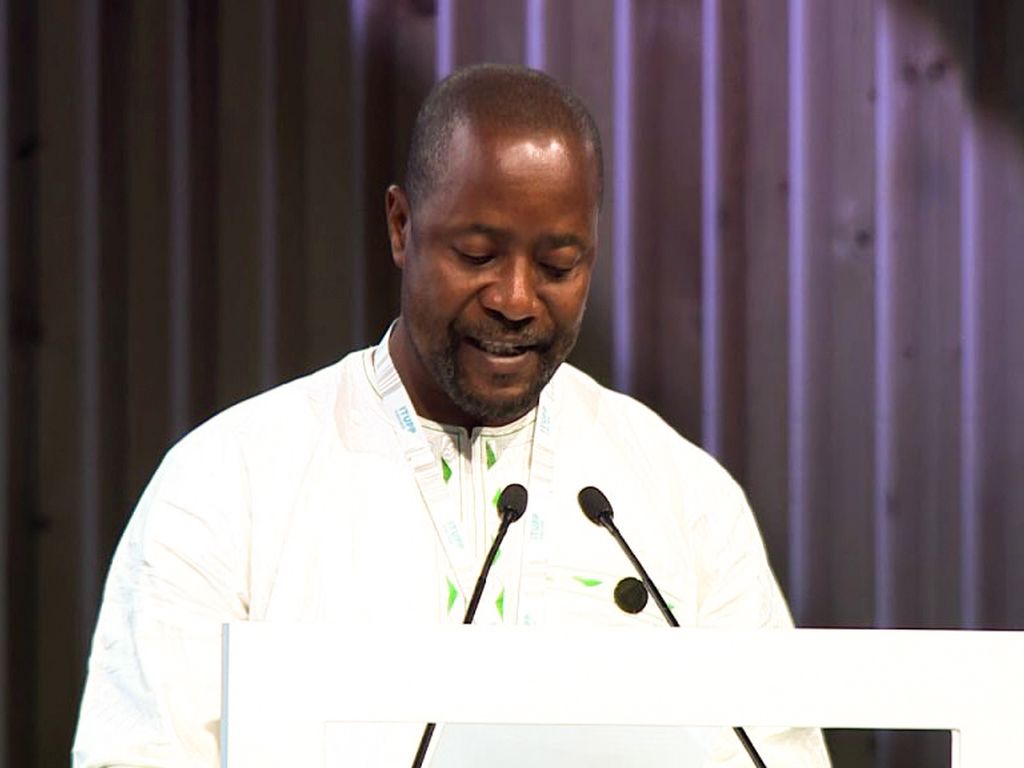

Abass Sesay is a Journalist and Development Analyst. He is a graduate in Development (undergrad), Corporate Governance, Governance and Leadership (postgrad).

Comments 0

Most Read

Recommended Post

.jpg)

Leave a Comment